The Canadian rental market has been witnessing remarkable growth and increasing demand, making it an excellent time to understand the rental landscape, particularly in the picturesque province of British Columbia (BC). With its diverse cities and breathtaking landscapes, BC offers residents an unparalleled blend of urban sophistication and natural beauty.

British Columbia’s Vibrant Cities

British Columbia, nestled in the westernmost part of Canada, is a captivating region with its stunning locales, a thriving job market, and a high quality of life. The province has become an attractive destination for those seeking a balanced urban lifestyle amidst nature’s splendour.

The region’s popularity has led to increasing demand for housing even as rental prices continue to surge in BC and Real Estate Canada, with Vancouver being notably more expensive than other cities. However, Burnaby, Surrey, Victoria, and Kelowna offer more affordable rental options with varying housing types to cater to diverse budgets.

Let’s explore BC’s vibrant cities and the unique experiences they offer to their residents.

Victoria – Old-World Charm and Cultural Delights

The capital of BC, Victoria, exudes old-world charm with its historic architecture and picturesque harbour. As a cultural hub, Victoria offers a thriving arts and culinary scene, making it an idyllic place to call home for those who appreciate a touch of tradition.

The average rental price for a one-bedroom apartment in Victoria is $2,071, while a two-bedroom apartment costs around $2,663.

Vancouver – Crown Jewel of BC

Vancouver, the bustling coastal metropolis, is a shining gem in BC’s crown. Boasting a vibrant cultural scene, world-class dining, and picturesque waterfronts, Vancouver caters to the tastes of outdoor enthusiasts and city dwellers. The city’s moderate climate and stunning views provide the perfect backdrop for an active and fulfilling lifestyle.

In the Metro Vancouver area, rent growth has been particularly notable in Richmond, where average asking rents for purpose-built and condominium apartments reached $2,974 in June, making it Canada’s third most expensive suburb. Richmond experienced an impressive annual rent inflation rate of 25.7%.

Burnaby – Modernity Meets Green Spaces

A neighbouring city to Vancouver, Burnaby offers a harmonious blend of modernity and green spaces. With many parks, recreational facilities, and family-friendly neighbourhoods, Burnaby provides an ideal backdrop for families and professionals seeking a serene yet connected community. In Burnaby, the average rental cost for a one-bedroom apartment is $2,578, and for a two-bedroom apartment, approximately $3,314.

Surrey – Dynamic Metro

Surrey, one of Canada’s fastest-growing cities, is a thriving hub with an urban lifestyle. With diverse neighbourhoods, excellent educational institutions, and a multicultural ambiance, Surrey real estate is an enticing choice for young families and those seeking an energetic urban atmosphere.

Renting a one-bedroom apartment in Surrey will cost around $1,954, while a two-bedroom apartment will cost approximately $2,449.

Kelowna – Oasis in the Okanagan Valley

Kelowna is nestled in the Okanagan Valley and boasts a delightful mix of wineries, orchards, and lakeside living. Renowned for its pleasant climate and recreational opportunities, the city attracts residents seeking a tranquil lifestyle and a thriving wine culture. In Kelowna, the average rental price for a one-bedroom apartment is $1,932, while a two-bedroom apartment costs around $2,635.

Rental Trends Across BC and Canada

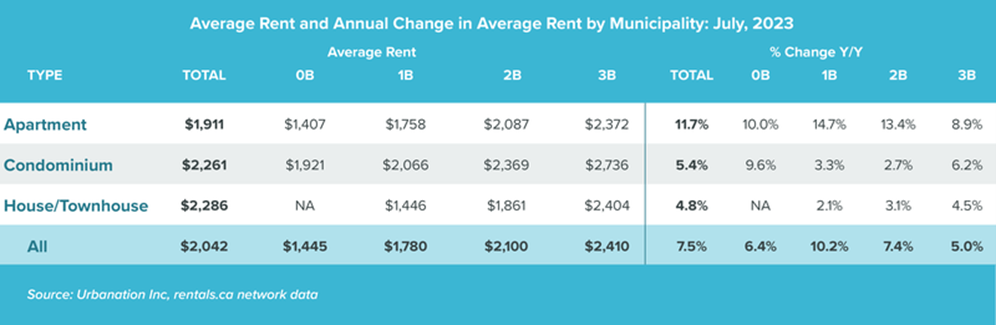

As of July 2023, rental prices in Canada have reached a record high, with the average asking rent hitting $2,042. This represents a 0.9% increase from the previous record set in November 2022 and a 1.4% increase from May, making it the fastest month-over-month growth this year. Over the past two years, average rents in Canada have surged by 20%, amounting to an average increase of $341.

In British Columbia (BC) and the Metro Vancouver area, rental prices have also experienced significant growth. British Columbia remains the most expensive province for tenants, with an average monthly asking rent of $2,550 for purpose-built and condominium apartments. Vancouver, representing Canada’s most expensive rental market, boasts an average asking rent of $3,301, followed by Toronto at $2,813.

CMHC Rental Housing Survey

The 2022 CMHC Rental Housing Survey sheds light on the evolving landscape of the Canadian rental market, revealing crucial insights that demand attention. The survey introduces two new indicators, measuring the share of affordable units for low-income renters and comparing average rents for newly rented units to those occupied for over a year.

Rental Growth and Affordability Concerns

The rental market in July 2023 continues to experience significant growth, witnessing record-high average rents across both British Columbia (BC) and Canada. Demand remains robust, fueled by population expansion and a near-record low unemployment rate. However, this surge in demand is accompanied by housing supply issues, leading to affordability concerns for low-income households in major centers.

Diverse Rent Growth Patterns

The survey showcases diverse rent growth patterns, with smaller units such as studios and one-bedroom apartments experiencing the fastest increase. One-bedroom units recorded an annual growth rate of 10.4%. In contrast, larger and more expensive units like two-bedroom and three-bedroom apartments have seen slower month-over-month growth, with increases of 0.7% and 0.8%, respectively.

Considerations for Affordable Housing

The findings highlight the pressing need to address housing supply challenges and consider the perspectives of everyone affected. Delays in housing for vulnerable groups and rent disparities between newly and long-occupied units call for targeted measures to ensure affordable housing. Encouraging private sector investment can play a vital role in addressing these concerns.

Exploring Homeownership

While the rental market presents opportunities for those seeking temporary housing solutions, exploring homeownership may be a good idea. The current rise in interest rates may give potential homebuyers pause. Still, it also provides an excellent chance to assess one’s financial capabilities and evaluate the advantages of purchasing a property in BC.

Though the cost of buying a house in BC might seem high, it is essential to consider the long-term benefits and investment potential. Homebuyers can gain valuable insights and assistance navigating the real estate market by consulting a trusted real estate agent. Exploring the options and making informed decisions can help prospective homeowners find the right property that aligns with their budget and needs.

Conclusion

It is important to recognize that while housing prices may appear high, several factors may make buying a house a viable option. The recent increase in interest rates has raised fears and expectations about the market, but it’s crucial to keep historical context in mind. The present housing prices are not exceptionally high compared to past rates, which may provide some perspective on the affordability of a property.

If you find yourself torn between renting and buying, a real estate agent can help you make an informed decision. They can assess your financial situation and guide you on the path best suits your needs and aspirations. With competitive rental markets in British Columbia’s vibrant cities, exploring the possibility of homeownership may lead to fulfilling your dream home amidst the province’s captivating allure.

Ultimately, while rental costs continue to rise, the allure of British Columbia’s natural beauty and thriving urban centers remains undeniable. Whether you seek a bustling urban lifestyle or a tranquil retreat, BC offers many living choices for every resident. So don’t be deterred by the seemingly high prices; take the time to consider your options, including the potential for homeownership, and seek professional advice to make the best choice for your future.